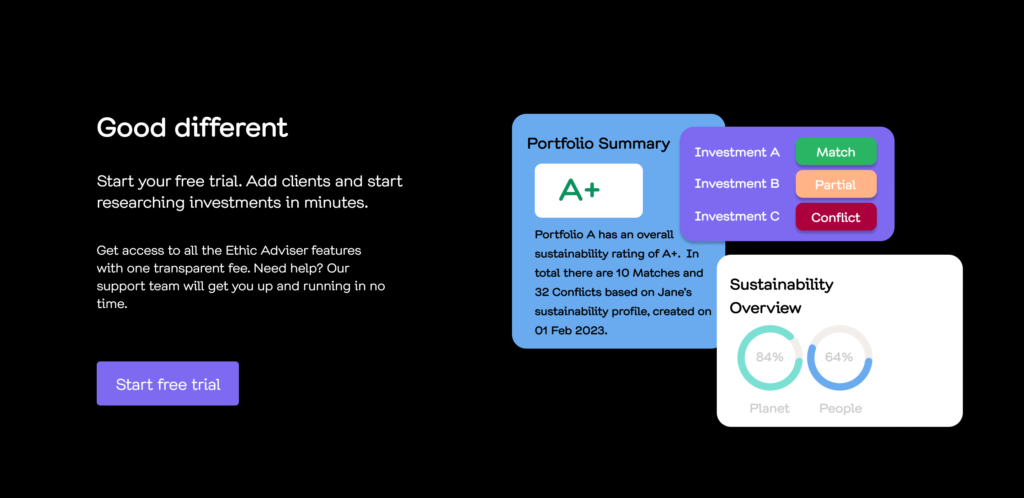

How Oko Platform Can Assist advisers in these murky waters:

In 2023, a significant shift occurred in the corporate world: reporting on Environmental, Social, and Governance (ESG) topics became a standard practice. This trend has provided investors with unprecedented insight into the environmental impact of companies’ operations and how environmental factors influence business performance. As frameworks for ESG reporting evolve, they increasingly resemble financial reporting in terms of both qualitative and quantitative disclosure.

However, unlike financial reporting, which adheres to strict standards ensuring consistency and accuracy, ESG reporting lacks a universal standard of rigor. This gap can lead to discrepancies between a company’s claims and its actions, harming stakeholders who rely on this information.

One well-known issue in ESG reporting is greenwashing, where companies portray themselves as more sustainable than they truly are. This phenomenon exists on a spectrum, ranging from deliberate deceit to wishful thinking. Additionally, newer terms like “greenhushing” and “green wishing” have emerged.

Green hushing occurs when a company refuses to publicize ESG information, fearing stakeholder backlash or concerns about financial returns. While not overtly dishonest, this lack of transparency impedes analysis of corporate sustainability efforts and hinders progress towards climate targets.

Greenwashing, on the other hand, involves setting ambitious sustainability goals without the means to achieve them. This practice can erode trust in companies and the broader system, particularly if goals are consistently missed.

Regulators are taking notice of these issues and are proposing rules to enhance ESG reporting standards. For example, the U.S. Securities and Exchange Commission (SEC) has proposed regulations to prevent the misuse of ESG terminology in investment funds. Similarly, the European Union’s Sustainable Finance Disclosure Regulation (SFDR) aims to improve transparency in financial products.

Despite regulatory efforts, companies must take proactive steps to mitigate the risk of greenwashing. This includes establishing robust ESG governance programs, educating stakeholders on ESG fundamentals, and staying informed about regulatory changes.

Transparency is key in building trust and creating long-term value. Companies that openly share their ESG strategies and reporting practices will not only comply with regulations but also drive value, gain a competitive edge, and promote resilience in the face of evolving environmental challenges.

1. Maintaining Trust and Credibility:

Clients rely on financial advisors for expert guidance and ethical decision-making. When advisors recommend investments that turn out to be greenwashed, it erodes trust and damages their professional reputation. Protecting clients from greenwashing is essential to maintaining credibility and long-term client relationships.

How Oko Can Assist:

Oko provides detailed, verified sustainability data that enables advisors to make recommendations based on accurate and transparent information, thus maintaining trust and credibility with their clients.

2. Ensuring Genuine Impact:

Greenwashing diverts funds away from truly sustainable initiatives, reducing the positive environmental and social impact that clients intend to achieve with their investments. By safeguarding clients from greenwashing, advisors help ensure that their investments contribute to genuine sustainability goals.

How Oko Can Assist:

Oko’s platform filters out greenwashed investments and highlights opportunities that meet rigorous sustainability standards, ensuring clients’ investments make a real difference.

3. Financial Integrity:

Investments in greenwashed products can lead to financial underperformance or losses if the true nature of these investments is exposed. Protecting clients from greenwashing helps secure their financial well-being and ensures their investments are sound and based on accurate information.

How Oko Can Assist:

Oko’s analytics provide a comprehensive assessment of the sustainability and financial performance of investment options, helping advisors select investments that are both ethical and financially sound.

4. Upholding Ethical Standards:

Advisors have a fiduciary duty to act in the best interests of their clients. Recommending greenwashed investments violates this duty and compromises the ethical standards of the profession. Protecting clients from greenwashing aligns with the core values of integrity and responsibility.

How Oko Can Assist:

Oko’s platform is designed with a focus on ethical investing, offering tools and insights that help advisors adhere to their fiduciary duties and maintain high ethical standards.

5. Enhancing Client Education:

By identifying and explaining the risks of greenwashing, advisors educate clients about the importance of due diligence and transparency in sustainable investing. This empowers clients to make informed decisions and fosters a more knowledgeable and discerning investor base.

How Oko Can Assist:

Oko provides educational resources and transparent data that advisors can use to educate their clients about sustainable investing and the importance of avoiding greenwashed products.

6. Promoting Industry Accountability:

When financial advisors take a stand against greenwashing, they contribute to broader industry efforts to hold companies accountable for their sustainability claims. This collective action helps promote higher standards of transparency and integrity in the market.

How Oko Can Assist:

By leveraging Oko’s platform, advisors join a network of professionals committed to transparency and accountability in sustainable investing, helping to raise industry standards and promote genuine sustainability.

By actively protecting clients from greenwashing and utilizing the Oko platform, financial advisors not only safeguard their clients’ interests but also reinforce the ethical foundations of the investment profession and contribute to the overall credibility of sustainable investing.