Greenwashing occurs when companies falsely claim their products, services, or operations are environmentally friendly, misleading investors and consumers alike. For Financial Advisors, the ability to discern genuine sustainable investments from greenwashed ones is paramount to safeguarding clients’ interests and fostering truly customer aligned investment portfolios. In the rapidly evolving landscape of sustainable investing, green washing has emerged as a significant challenge.

What is Greenwashing?

Greenwashing is a deceptive practice where a company exaggerates or fabricates its environmental credentials to appeal to environmentally conscious investors and consumers. This can range from misleading marketing campaigns to outright false claims about sustainability efforts.

The Impact of Greenwashing on Investments

- **Erosion of Trust**: When greenwashing is exposed, it can lead to a significant loss of trust in both the company and the advisor who recommended the investment. This erosion of trust can have long-lasting effects on client relationships.

- **Financial Risk**: Investments in companies engaged in greenwashing may face financial penalties, reputational damage, and loss of market value once their deceptive practices are revealed. This can result in substantial financial losses for investors.

- **Undermining Genuine Sustainability Efforts**: Greenwashing diverts capital away from genuinely sustainable companies, undermining efforts to address environmental challenges and advance sustainability goals.

How to Identify Greenwashing

- **Scrutinize Claims**: Look beyond marketing materials and scrutinize the actual practices and policies of a company. Verify claims through third-party certifications and independent audits.

- **Assess Transparency**: Genuine sustainable companies are transparent about their practices, providing detailed and accessible information about their environmental impact and sustainability efforts.

- **Follow the Money**: Analyze where a company invests its profits and resources. Companies truly committed to sustainability will reinvest in environmentally friendly technologies and practices.

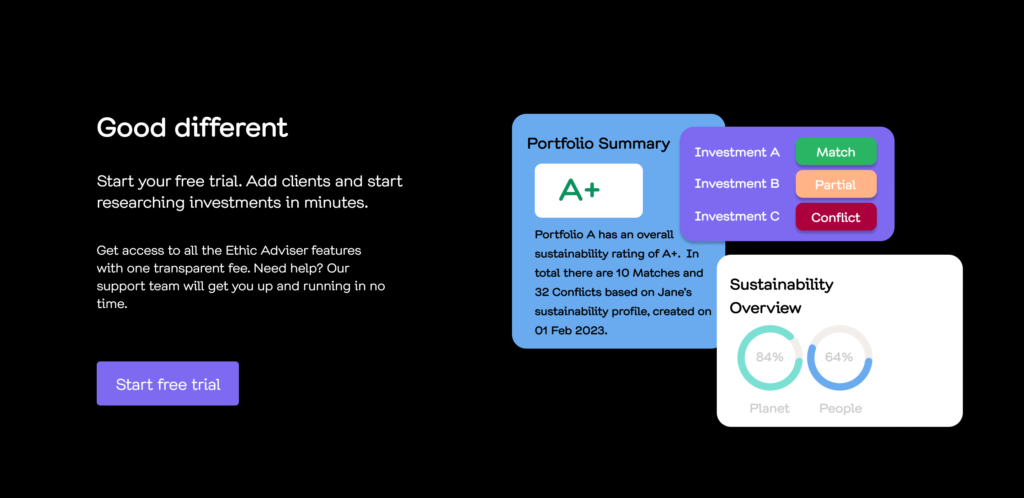

Why It’s Important to Protect Clients from Greenwashing and How Oko Platform Helps

**1. Maintaining Trust and Credibility:**

Clients rely on financial advisors for expert guidance and ethical decision-making. When advisors recommend investments that turn out to be greenwashed, it erodes trust and damages their professional reputation. Protecting clients from greenwashing is essential to maintaining credibility and long-term client relationships.

Oko provides detailed, verified sustainability data that ensures advisors can make recommendations based on accurate and transparent information, maintaining trust and credibility with their clients.

**2. Ensuring Genuine Impact:**

Greenwashing diverts funds away from truly sustainable initiatives, reducing the positive environmental and social impact that clients intend to achieve with their investments. By safeguarding clients from greenwashing, advisors help ensure that their investments contribute to genuine sustainability goals.

Oko’s platform filters out greenwashed investments and highlights opportunities that meet rigorous sustainability standards, ensuring clients’ investments make a real difference.

**3. Financial Integrity:**

Investments in greenwashed products can lead to financial underperformance or losses if the true nature of these investments is exposed. Protecting clients from greenwashing helps secure their financial well-being and ensures their investments are sound and based on accurate information.

Oko’s analytics provide a comprehensive assessment of the sustainability and financial performance of investment options, helping advisors select investments that are both ethical and financially sound.

**4. Upholding Ethical Standards:**

Advisors have a fiduciary duty to act in the best interests of their clients. Recommending greenwashed investments violates this duty and compromises the ethical standards of the profession. Protecting clients from greenwashing aligns with the core values of integrity and responsibility.

Oko’s platform is designed with a focus on ethical investing, offering tools and insights that help advisors adhere to their fiduciary duties and maintain high ethical standards.

**5. Enhancing Client Education:**

By identifying and explaining the risks of greenwashing, advisors educate clients about the importance of due diligence and transparency in sustainable investing. This empowers clients to make informed decisions and fosters a more knowledgeable and discerning investor base.

Oko provides educational resources and transparent data that advisors can use to educate their clients about sustainable investing and the importance of avoiding greenwashed products.

**6. Promoting Industry Accountability:**

When financial advisors take a stand against greenwashing, they contribute to broader industry efforts to hold companies accountable for their sustainability claims. This collective action helps promote higher standards of transparency and integrity in the market.

By leveraging Oko’s platform, advisors join a network of professionals committed to transparency and accountability in sustainable investing, helping to raise industry standards and promote genuine sustainability.

By actively protecting clients from greenwashing and utilizing the Oko platform, financial advisors not only safeguard their clients’ interests but also reinforce the ethical foundations of the investment profession and contribute to the overall credibility of sustainable investing.